Domme Resources

Taxes for Dommes

Taxes for Dommes

One of the biggest mistakes you can make, as a newer Domme in the USA, is not pay taxes on the income you make. As an online dominatrix, you are self employed. This means you are responsible for keeping track of your income and expenses for your end-of-the-year taxes.

If there is one thing you take away from this article, please remember:

You must pay your taxes!

You must pay your taxes!

You must pay your taxes!

Not doing so can result in pure, utter chaos. Having the IRS involved in your life is no joke. Avoid any and all problems by, again, paying your taxes!

Hire a Tax Professional

The best decision you can make for yourself is to hire a tax professional that understands our industry. Luckily, one such tax professional exists. I highly recommend: Cam Sparrow aka The Taxxx Guy

Income & Deductions

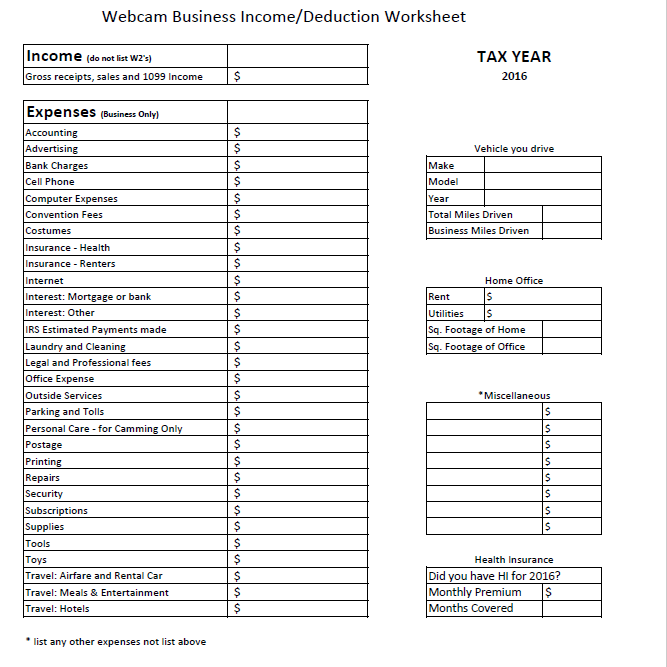

On Cam’s website, there is an income and deduction worksheet that can serve as a general guide on what you should be keeping track of. Here is a photo:

Documents Needed for Your Tax Return

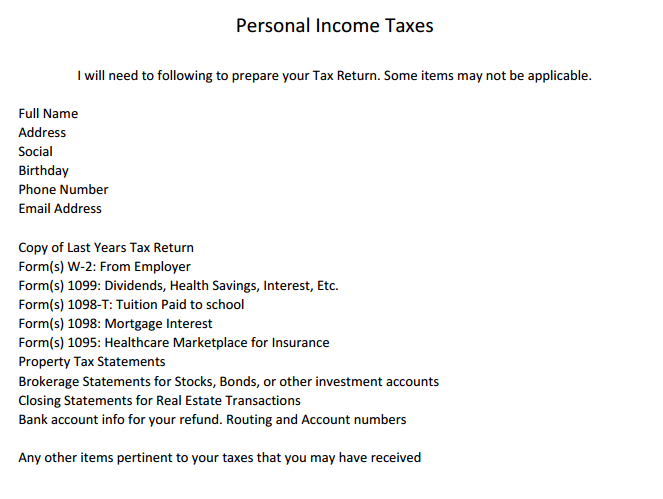

Additionally, Cam’s website has a guide on what you will need to provide, in order for him to file your taxes. Here is the photo:

It is best to direct all of your tax related questions to him, as I am not a tax professional and am thus not qualified for any important questions.

Starting a Company

I will say, though, that as you get more and more successful, it may even make sense to open up an LLC or an S Corp and filing your taxes this way as oppose to being a Sole Proprietorship. What’s best for you will depend on many variables, all of which can be directed towards Cam Sparrow, once he is your tax professional.

FemDom Friendly Cam Sites

There are many FemDom friendly cam sites to use as either your main site or supporting site! Check out My List of FemDom Friendly Cam Sites!

FemDom Friendly Clip Sites

In addition to camming, selling FemDom clips is a great way to make money as an online female dominatrix. Check out my My List of FemDom Friendly Clip Sites!